Personal Finance

From Rich Dad, Poor Dad to The Millionaire Next Door, from Rich Dad, Poor Dad to Money and Marriage, we can help you find the personal finance books you are looking for. As the world's largest independent marketplace for new, used and rare books, you always get the best in service and value when you buy from Biblio.co.uk, and all of your purchases are backed by our return guarantee.

Top Sellers in Personal Finance

Rich Dad, Poor Dad

by Robert T ; Lechter, Sharon L Kiyosaki

Rich Dad Poor Dad is a book by Robert Kiyosaki and Sharon Lechter. It advocates financial independence through investing, real estate, owning businesses, and the use of finance protection tactics. Rich Dad Poor Dad is written in an anecdotal manner and is aimed at creating public interest in finance. Kiyosaki and Lechter stress the advocacy of owning the system or means of production, rather than being an employee as a recurring theme in the book's chapters.

Secrets Of the Millionaire Mind

by Eker- T Harv

Secrets of the Millionaire Mind reveals the missing link between wanting success and achieving it!Have you ever wondered why some people seem to get rich easily, while others are destined for a life of financial struggle? Is the difference found in their education, intelligence, skills, timing, work habits, contacts, luck, or their choice of jobs, businesses, or investments?The shocking answer is: None of the above!In his groundbreaking Secrets of the Millionaire Mind, T. Harv Eker states: "Give me five...

Read more about this item

Rich Dad, Poor Dad

by Robert T Kiyosaki

Rich Dad Poor Dad is a book by Robert Kiyosaki and Sharon Lechter. It advocates financial independence through investing, real estate, owning businesses, and the use of finance protection tactics. Rich Dad Poor Dad is written in an anecdotal manner and is aimed at creating public interest in finance. Kiyosaki and Lechter stress the advocacy of owning the system or means of production, rather than being an employee as a recurring theme in the book's chapters.

The Millionaire Next Door

by Thomas J Stanley

The book The Millionaire Next Door: The Surprising Secrets of America's Wealthy is by Thomas J. Stanley and William D. Danko. This book is a compilation of research done by the two authors in the profiles of 'millionaires'. In this case they used the term 'millionaire' to denote U.S. households with net-worths exceeding one million dollars (USD).

The Millionaire Next Door

by Thomas J ; Danko, William D Stanley

Published in 1996 is a compilation of research done by the authors, Thomas J Stanley and William D Danko, on people in the US whose net-worth exceeds a million dollars. Centered around their findings that most millionaire’s do not lead extravagant lifestyles, but rather live below their means and save and invest their money, It is considered to be a classic in financial self-help genre. -

The One Minute Millionaire

by Mark Victor; Allen, Robert G Hansen

Would you like to know the secrets to making all the money you'll ever want?Now, two mega-bestselling authors with decades of experience in teaching people how to achieve extraordinary wealth and success share their secrets. Mark Victor Hansen, cocreator of the phenomenal Chicken Soup for the Soul series, and Robert G. Allen, one of the world's foremost financial experts, have helped thousands of people become millionaires. Now it's your turn.Is it possible to make a million dollars in only one minute?...

Read more about this item

Rich Dad's Guide To Investing

by Robert T ; Lechter, Sharon L Kiyosaki

'Rich Dad's Guide to Investing' follows the New York Times bestsellers 'Rich Dad, Poor Dad' and 'Rich Dad's CASHFLOW Quadrant'. Most of us know that the best investments never make it to market. This book discusses what the rich invest in that the poor and middle class do not. What follows is an insider's look into the world of investing, how the rich find the best investments, and how you can too. Robert Kiyosaki and Sharon Lechter show . . .7 Rich Dad's basic rules of investing 7 How to reduce your...

Read more about this item

Financial Peace Revisited

by Dave Ramsey

Dave Ramsey knows what it's like to have it all. By age twenty-six, he had established a four-million-dollar real estate portfolio, only to lose it by age thirty. He has since rebuilt his financial life and, through his workshops and his New York Times business bestsellers Financial Peace and More than Enough, he has helped hundreds of thousands of people to understand the forces behind their financial distress and how to set things right-financially, emotionally, and spiritually. In this new edition...

Read more about this item

The Automatic Millionaire

by David Bach

What's the secret to becoming a millionaire?For years people have asked David Bach, the national bestselling author of Smart Women Finish Rich, Smart Couples Finish Rich, and The Finish Rich Workbook, what's the real secret to getting rich? What's the one thing I need to do?Now, in The Automatic Millionaire, David Bach is sharing that secret. The Automatic Millionaire starts with the powerful story of an average American couple--he's a low-level manager, she's a beautician--whose joint income never...

Read more about this item

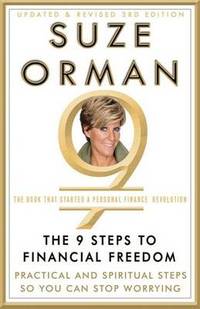

9 Steps To Financial Freedom

by Suze Orman

Financial expert Suze Orman is changing the way America thinks about money. She outlines a revolutionary approach to the way we save money, handle debt, and plan for our retirement. By examining and understanding our earliest attitudes toward money, we can honestly confront where we stand financially and take the necessary action toward financial freedom. Orman deals with managing money responsibly, handling credit card debt, planning for our retirement, trusts versus wills and more. You will understand...

Read more about this item

Ordinary People, Extraordinary Wealth

by Ric Edelman

New York Times bestselling author Ric Edelman is one of the nation's best-known and most successful financial advisors.

Women & Money

by Suze Orman

Why is it that women, who are so competent in all other areas of their lives, cannot find the same competence when it comes to matters of money?Suze Orman investigates the complicated, dysfunctional relationship women have with money in this groundbreaking new book. With her signature mix of insight, compassion, and soul-deep recognition, she equips women with the financial knowledge and emotional awareness to overcome the blocks that have kept them from making more out of the money they make. At the...

Read more about this item

The Millionaire Mind

by Thomas J Stanley

"Readers with an entrepreneurial turn of mind will devour The Millionaire Mind because it provides road maps on how millionaires found their niches."After its first publication, Dr. Thomas J. Stanley's second best-seller The Millionaire Mind spent over four months on the New York Times best-seller list, rising to position #2, and has sold over half a million copies. Here is the first paperback edition of Stanley's second groundbreaking study of America's wealthy.The Millionaire Mind targets a...

Read more about this item

Smart Couples Finish Rich

by David Bach

David Bach is the host of his own PBS television special in the U.S. and is widely recognized as one of America’s leading financial advisors and educators. Bach’s investment principles are taught internationally by thousands of financial advisors through his Smart Women Finish Rich™ and Smart Couples Finish Rich™ seminars, which are now available across Canada in over 100 cities.

Smart Women Finish Rich

by David Bach

David Bach is the host of his own PBS television special in the U.S. and is widely recognized as one of America’s leading financial advisors and educators. Bach’s investment principles are taught internationally by thousands of financial advisors through his Smart Women Finish Rich™ and Smart Couples Finish Rich™ seminars, which are now available across Canada in over 100 cities.

Start Late, Finish Rich

by David Bach

David Bach has a plan to help you live and finish rich--no matter where you startSo you feel like you've started late?You are not alone. What if I told you that right now as you flip through this book, 70% of the people in the store with you are living paycheck to paycheck?What if I told you that the man browsing the aisle to your left owes more than $8,000 in credit card debt? And the woman on your right has less than $1,000 in savings? See? You're really not alone.Unfortunately, the vast majority of...

Read more about this item

Why We Want You To Be Rich

by Donald J ; Kiyosaki, Robert T ; McIver, Meredith; Lechter, Sharon Trump

Personal Finance Books & Ephemera

Rich Dad, Poor Dad

by Kiyosaki, Robert T ; Lechter, Sharon L

Rich Dad Poor Dad is a book by Robert Kiyosaki and Sharon Lechter. It advocates financial independence through investing, real estate, owning businesses, and the use of finance protection tactics. Rich Dad Poor Dad is written in an anecdotal manner and is aimed at creating public interest in finance. Kiyosaki and Lechter stress the advocacy of owning the system or means of production, rather than being an employee as a recurring theme in the book's chapters.

Smart Couples Finish Rich

by David Bach

David Bach is the host of his own PBS television special in the U.S. and is widely recognized as one of America’s leading financial advisors and educators. Bach’s investment principles are taught internationally by thousands of financial advisors through his Smart Women Finish Rich™ and Smart Couples Finish Rich™ seminars, which are now available across Canada in over 100 cities.

Smart Women Finish Rich

by David Bach

David Bach is the host of his own PBS television special in the U.S. and is widely recognized as one of America’s leading financial advisors and educators. Bach’s investment principles are taught internationally by thousands of financial advisors through his Smart Women Finish Rich™ and Smart Couples Finish Rich™ seminars, which are now available across Canada in over 100 cities.

Start Late, Finish Rich

by David Bach

David Bach has a plan to help you live and finish rich--no matter where you startSo you feel like you've started late?You are not alone. What if I told you that right now as you flip through this book, 70% of the people in the store with you are living paycheck to paycheck?What if I told you that the man browsing the aisle to your left owes more than $8,000 in credit card debt? And the woman on your right has less than $1,000 in savings? See? You're really not alone.Unfortunately, the vast majority of...

Read more about this item

The Automatic Millionaire

by David Bach

What's the secret to becoming a millionaire?For years people have asked David Bach, the national bestselling author of Smart Women Finish Rich, Smart Couples Finish Rich, and The Finish Rich Workbook, what's the real secret to getting rich? What's the one thing I need to do?Now, in The Automatic Millionaire, David Bach is sharing that secret. The Automatic Millionaire starts with the powerful story of an average American couple--he's a low-level manager, she's a beautician--whose joint income never...

Read more about this item

Financial Peace Revisited

by Ramsey, Dave

Dave Ramsey knows what it's like to have it all. By age twenty-six, he had established a four-million-dollar real estate portfolio, only to lose it by age thirty. He has since rebuilt his financial life and, through his workshops and his New York Times business bestsellers Financial Peace and More than Enough, he has helped hundreds of thousands of people to understand the forces behind their financial distress and how to set things right-financially, emotionally, and spiritually. In this new edition...

Read more about this item

Women & Money

by Orman, Suze

Why is it that women, who are so competent in all other areas of their lives, cannot find the same competence when it comes to matters of money?Suze Orman investigates the complicated, dysfunctional relationship women have with money in this groundbreaking new book. With her signature mix of insight, compassion, and soul-deep recognition, she equips women with the financial knowledge and emotional awareness to overcome the blocks that have kept them from making more out of the money they make. At the...

Read more about this item

Ordinary People, Extraordinary Wealth

by Edelman, Ric

New York Times bestselling author Ric Edelman is one of the nation's best-known and most successful financial advisors.

Nice Girls Don't Get Rich

by Frankel, Lois P

If you have outstanding balances on your credit cards...don't have assets in your own name...are saving instead of investing, then chances are you're not rich and not living the life you want. Without your awareness, behaviors learned as a girl are preventing you from becoming a woman who is financially independent and free to follow her dreams. Now, with the same frank advice and empowering information that made Nice Girls Don't Get the Comer Office a bestseller, Lois Frankel tackles the 75 financial...

Read more about this item

9 Steps To Financial Freedom

by Orman, Suze

Financial expert Suze Orman is changing the way America thinks about money. She outlines a revolutionary approach to the way we save money, handle debt, and plan for our retirement. By examining and understanding our earliest attitudes toward money, we can honestly confront where we stand financially and take the necessary action toward financial freedom. Orman deals with managing money responsibly, handling credit card debt, planning for our retirement, trusts versus wills and more. You will understand...

Read more about this item

A Gift To My Children

by Rogers, Jim

Jim Rogers co-founded the Quantum Fund before he turned 30 and retired at age thirty-seven. Since then, he has served as a sometime professor of finance at Columbia University’s business school, and as a media commentator worldwide. He is the author of A Bull in China, Hot Commodities, Adventure Capitalist, and Investment Biker. He recently moved to Asia with his wife and daughters.